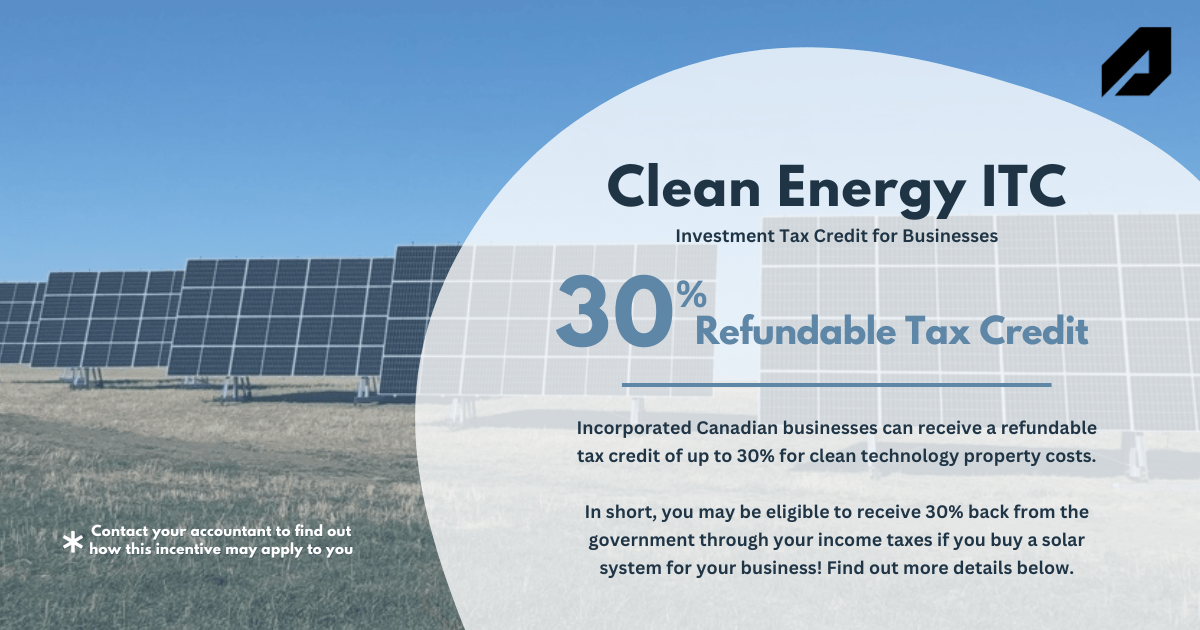

Clean Energy ITC: 30% Refundable Tax Credit for Solar

The Clean Technology ITC is a refundable 30% tax credit on capital cost of investments made by taxable entities in wind, solar PV and energy-storage technologies.

This credit is only available to taxable Canadian corporations and partnerships in which a taxable Canadian corporation is a partner. Individuals and tax-exempt entities are not eligible.

The refundable credit is available for solar equipment acquired from March 28, 2023 until December 31, 2033. Equipment acquired in 2034 will be eligible for a reduced 15% refundable tax credit. After 2034, the credit will no longer be available.

Renewable Energy for your Farm or Business

With the increase of available rebates and tax credits for clean technologies, now is the perfect time to consider switching to solar! Our team at Azgard will work closely with you to help you understand your energy needs and determine the best course of action to meet them. Our goal is to lower your electricity bills while utilizing these readily-available incentives and programs to further reduce your end-project costs as well as your payback timeline. Contact us today to start your solar journey.

For full details on the Investment Tax Credit, click here or speak with your accountant to find out how this incentive may apply to you.